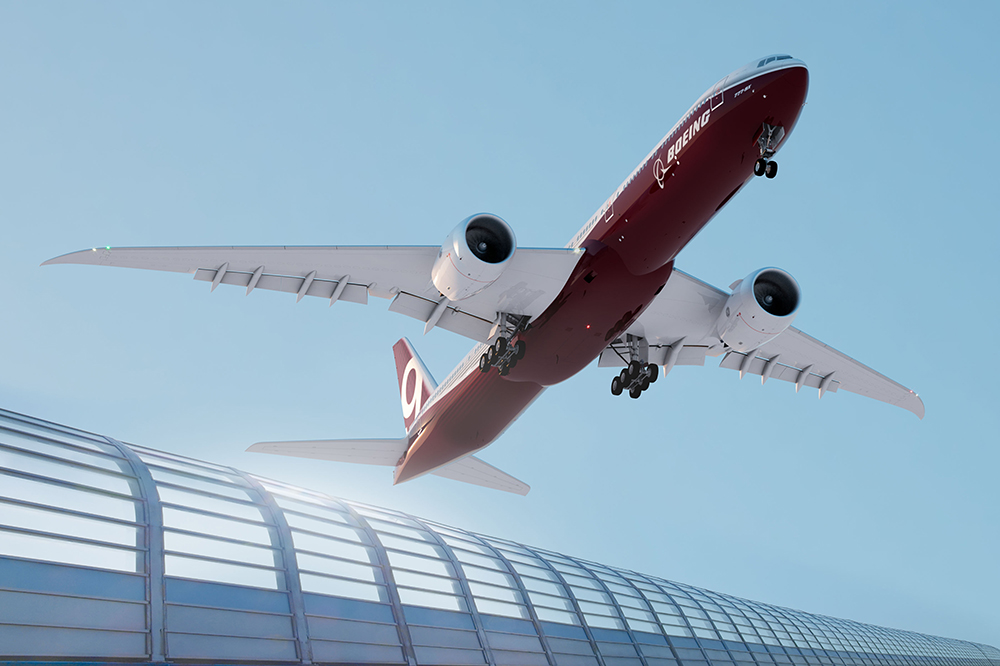

Emirates B777x

Emirates doubts it will receive any of the 115 Boeing 777-9s it has ordered next year, its president said on Monday, as the U.S. Planemaker grapples with challenges in building the jet. Emirates is weighing a fresh order for Boeing Co. ’s behemoth 777X twin-aisle plane as part of a complex series of transactions that would remake its fleet plans and likely spell the end of Airbus. DUBAI — Emirates Airline President Tim Clark on Wednesday said Boeing Co’s 777X might not enter into service with airlines until 2023 or even later, amid uncertainty over the development timeline of Boeing’s biggest twin-engine jet and when it will be certified. Emirates is also looking at possibly substituting part of their 777X order for 787s instead. Emirates had signed a letter of intent for 40 Boeing 787-10s but never executed that, so it sounds like they may now be looking to swap around part of their order, and maybe pick up some 787s at the expense of some 777 orders. Currently, the official B777X-backlog is made up by All Nippon Airways (20), British Airways (18), Cathay Pacific (21), Emirates (115), Etihad (25), Lufthansa (20), Qatar Airways (60), Singapore Airlines (20) and Undisclosed (10). Just eight of these are for the B777-8 (all for Etihad), while the remaining 301 are for the B777-9.

38% of B777X firm orders are 'soft'

Boeing said that just over a third of its firm orders for the B777X can be seen as 'soft' and can't be counted anymore as firm due to accounting rules. 118 of the 309 orders have been moved to the so-called 'ASC 606 adjustment' column. These adjustments are based on the contractual commitments issues (delays), but also the financial condition of the customers.

Currently, the official B777X-backlog is made up by All Nippon Airways (20), British Airways (18), Cathay Pacific (21), Emirates (115), Etihad (25), Lufthansa (20), Qatar Airways (60), Singapore Airlines (20) and Undisclosed (10). Just eight of these are for the B777-8 (all for Etihad), while the remaining 301 are for the B777-9.

According to several aviation analysts the uncertain orders are from Etihad Airways, which already said it was planning to take delivery of only six B777Xs instead of the 25 it has on order. Emirates is also said to be willing to downsize its order in favor of the B787, just like the airline did in 2019 when it decided to swap orders for 35 B777Xs to the B787. The last airline flagged as uncertain is presumably Cathay Pacific, which is severely impacted by the Corona-pandemic and already deferred delivery to 2025 onwards.

Last month, during it's annual results presentation, Boeing announced that the first delivery of the B777X has now been moved to 2023. This is due to a combination of delays with the aircraft itself, as well as deferrals by customers due to the current (passenger) aviation crisis.

Photo by Boeing.

22/07/2020

In response to the Airbus A350 program, Boeing unveiled its revamped 777X model with plans to fly it in 2017 and an entry into service date of 2019. Designated to become the largest twin-engine widebody and equipped with the latest General Electric GE9X engines and folding Wingtips, the Boeing 777X aircraft attracted a total of 66 orders in 2013. These consisted of orders from Lufthansa (20), Etihad Airways (25) and Cathay Pacific Airways (21). Emirates, in the following year, recorded the largest single order of 150 Boeing 777X models, which were then supplemented by 50 orders from Qatar Airways and 20 from ANA in the same year. Therefore, the number of orders received in 2014 accounted for over 60% of the aggregate order number for the Boeing 777X to date, according to IBA.iQ, as of July 2020.

The twin-engine widebody has seen little growth in its order book since 2015, receiving only 58 orders from three airlines and one unidentified customer. Its latest confirmed order for 18 aircraft came from IAG and was announced at the 2019 Paris Air Show. The challenges of attracting more 777X orders stem not only from manufacturing delays caused by unexpected wear on the GE9X engine compressor, but also a combination of key external factors including widebody secondary market oversupply, the low fuel environment and the 737 MAX grounding. These negative influences have been amplified by the Covid-19 outbreak.

In light of the global pandemic, extra-large widebodies such as the Airbus A380 and Boeing 747 aircraft have been downgraded and their retirements from existing fleets accelerated. This indicates demand in this sector has been significantly cut and oversupply has been exacerbated. In addition to the early retirements, airline customers have been considering delaying deliveries of the Boeing 777X aircraft. Both Emirates and Lufthansa, both of which initially planned to receive their first 777X deliveries in 2020, have rescheduled for 2021 according to Boeing. The German national carrier is committing to a 2021 delivery despite the slowdown in its programme because of the pandemic.

In November 2019 Boeing reported a change to its 777X orderbook, disclosing that Emirates exercised an order conversion for 30 B777X to the B787-9 aircraft and 11 confirmed B777X to options. At the same time, Emirates revealed that six of its 777-300ER orders were converted to the B777X which resulted in a total of 115 confirmed B777X orders in its current backlog. Due to Covid-19's impact on travel and the consequent imposition of global restrictions, airlines have been struggling and seeking out financial support so they can survive the unprecedented situation. Global downsizing in the fleets of airline companies has already begun and OEMs have introduced further cuts in their production lines, with the Boeing 777/777X combined production rate to be reduced to three per month in 2021.

IBA has reviewed the current order backlog and the corresponding delivery stream of the Boeing 777/777X family so as to illustrate and highlight the plausible alternations to both order and delivery characteristics as a result of Covid-19. In this analysis, we are focusing on the current balance of Boeing 777/777X passenger aircraft orders received so far and excluding any speculative future orders. Please also note that the delivery figures in 2020 represent the whole year and do not include aircraft which have been built but not yet delivered due to the pandemic.

Based on data from IBA.iQ, there were 309 Boeing 777X aircraft in Boeing's orderbook as of January 2020 plus 35 Boeing 777-300ERs and two 777-200LR aircraft which are expected to be delivered between 2020 and 2023. Due to the Covid-19 outbreak, Boeing has rescheduled introduction of its first 777-9X aircraft until at least 2021 and its 777-8X model until the following year. Therefore, the forecasted delivery pattern will inevitably be reshaped in the post-Covid era.

In view of the delivery schedule alterations prompted by Covid, we have considered two scenarios regarding Boeing 777/777X future deliveries. In the ‘Base Case' scenario, we assume all orders in the current backlog will be fulfilled. However, since Boeing has adjusted its production rate for the B777/777X family, the subsequent production ramp-up for the 777Xs will be deferred by approximately 4-6 years.

Although air passenger traffic has begun to slowly recover from the global pandemic, we believe Covid-19's impact on the global aviation industry will be long lasting. As airlines continue to file for bankruptcy or to enter Chapter 11 rejection scenarios, and the threat of a plausible second wave persists, any potential V-Shaped recovery is a long way off. Hence, it is essential we evaluate and prepare for a prolonged post-Covid crisis, which we define as the worst-case scenario in this analysis.

While Boeing continues its 777X testing program, some airlines question the likelihood of an entry into commercial service occurring in 2021, as is currently planned. This concern has recently been highlighted by its largest customer, Emirates, in a recent interview with Bloomberg. Since Emirates expects its first delivery no sooner than 2022, we have adjusted the entry into service date of the first B777X aircraft to 2022 in our ‘Post-Covid Crisis Case'.

In aggregate, we expect around one fifth of Boeing 777X current orders to be either converted to other models or cancelled in this ‘Crisis Case'. This is mainly due to airlines being desperate to ameliorate their balance sheets by removing their order burdens to help them survive the aftermath of Covid. Moreover, international travel demand is expected to take much longer to recover, which will significantly affect widebody operators. In April 2020, Cathay Pacific was contemplating adjustments to its B777X order, including lengthy delivery deferrals and the possibility of switching to the Boeing 787-10. Troubled Lufthansa is currently negotiating a restructuring deal with its shareholders, which might include a requirement to trim or remove its Boeing 777X commitment. The German flagship carrier already operates 16 Airbus 350-900s and has an additional 27 in its backlog.

Turning to the Boeing 777-300ER order backlog, we believe it will be challenging to deliver all remaining orders. In 2012, Pakistan International Airlines placed an order for five 777-300ER aircraft which has since been in hibernation for over eight years. This order is likely to be converted to other Boeing aircraft types since the airline deposited US$ 50M when they made the purchase order. In addition, 15 777-300ER aircraft were ordered between 2014 and 2015 by unidentified customer(s) and are waiting to be delivered. However, many more aircraft have since been ordered and have already been delivered, leaving the future of the undisclosed orders uncertain.

Although the Post Covid ‘Crisis' scenario for the future of the Boeing 777X family seems pessimistic, some airline customers remain positive about the newly developed widebody. In June 2020, Qatar Airways announced it will retire its entire fleet of Boeing 777-200LR and 777-300ER aircraft over the next four years. This will pave the way for the Boeing 777X. Since it will also accelerate retirements of its A330s in the near term and its A380 fleet by 2028, it is likely that Qatar will place some top-up orders for Boeing 777X models in the future. According to IBA.iQ, the Middle East carrier currently has 10 B777-8 and 50 B777-9 aircraft in its backlog.

Apart from Qatar Airways, both Emirates and Etihad Airways show appetite for more Boeing 777X aircraft in their future fleets. Being the largest operator of both the Boeing B777-300ER (133) and the Airbus A380-800 (115), we expect Emirates will require more widebodies to fill the void created by the early retirements of its A380 fleet. Since there are more Boeing 777X in its backlog than the Airbus A350 family, the future top-up order will lean towards Boeing. Etihad expects to need more widebodies once it recovers from the current pandemic, and its orders are likely to be for B777Xs or A350s.

In order to examine which airlines are likely to place orders for Boeing 777Xs in the future, we have created an illustrative chart which presents each airline with a score on an index of 10, 10 being the maximum and 0 the minimum. Essentially, the airline score index is an overview of a number of criteria which we're applying to assess the possibility of any future B777X orders. From an operational perspective, important elements include whether the airlines have any existing B777X orders or orders from competitive models such as the A350 and B787. We also consider whether the airline operates B777 family aircraft or has any A380s or B747s in its current fleet. The model takes several financial criteria into account as well, such as whether the airline required financial aid to overcome the Covid crisis, how the airline's financial status compares with the previous year and the forecast of its financial status in the near future.

Based on the criteria mentioned above, we have established a chart which includes 20 airlines that are more or less likely to place future Boeing 777X orders. Most of the listed airlines are national flagship carriers which have wide international routes in their network, such as Air China, Saudi Arabian Airlines, ANA and Korean Air. Further, international airlines like Eva Air and Bamboo Airways are among the B777X's potential customers. Bamboo Airways has also been considering the 777X for US routes in forthcoming years. Many B777-300ER operators in Europe or North America have chosen to switch either to A350s, for example Aeroflot and Turkish Airlines, or to scale down to the B787 as a replacement, as in the case of Air Canada and American Airlines. Hence, potential bidders for the B777X are mainly from the Middle East and Asia Pacific regions.

Although the Boeing 777X will eventually enter into service and gradually replace old variants, Boeing's 777-300ER will remain a significant figure in this market segment with nearly 800 in-service units operating as of July 2020. A combination of the low fuel environment, the delayed B777X programme and the high popularity of large twin-engine widebodies has resulted in a recent increase in B777-300ER lease extensions.

In October 2019, freighter conversion specialist Israel Aerospace Industries (IAI) and leasing giant GECAS unveiled the designated B777-300ER Special Freighter, with a launch order of 15 firm conversions and 15 options. In early June, GECAS delivered a B777-300ER to IAI for freighter conversion, which will become the prototype B777-300ERSF. Since the Boeing 777-300/300ER is the most popular aircraft type to be operated as a temporary freighter in the Coronavirus lockdown period, prospects for the B777-300ER freighter conversion programme look promising. The table below illustrates the passenger aircraft types which were employed as temporary freighters as of June.

The market value and lease rates of mid-aged or older Boeing 777-300ER aircraft have been relatively stable compared with other similar widebody types. Current owners and operators of this type are more likely to hold onto the asset as potential feedstock for the converted Special Freighter, which has 25% more cargo capacity than the standard B777 freighter but maintains 90% commonality with its B777F counterpart. Even though a proposed 777X freighter is expected in the long-term, the initial B777 freighters will be approximately 10 years old by 2025. So far, Boeing has been vague about the specifications of its 777X freighter. All we know is that it is likely to be based on the smaller variant Boeing 777-8, which will be six meters longer than the Boeing 777-200LRF freighter.

Despite prospects for large widebody aircraft having been dented by the global pandemic, we remain positive about the future of Boeing's 777X programme. Since most 777-300ER orders have been followed by its entry into service, we expect the 777X to perform similarly. However, we doubt order numbers will overtake those of the 777-300ER model due to direct competition from the Airbus A350 family which has comfortably occupied this market sector. Unlike the Airbus A380 and Boeing 747 aircraft which are currently facing early retirement or fleet downsizing, the performance of twin-engine widebodies remains relatively consistent. As some airlines start to phase out their Boeing 777 fleet over the coming decade, we are likely to witness Boeing 777X family aircraft in the portfolios of the Middle East and Asia-Pacific flag carriers.

Please contact Jie Zhou, our Senior Aviation Analyst, if you have any further questions, comments or feedback on the analysis discussed.

The data featured within this article is derived from IBA.iQ, our leading platform for aviation intelligence. We are currently offering free system demonstrations, sign up here.

Author

Sign up for our newsletter

_(cropped).jpg)

Related content